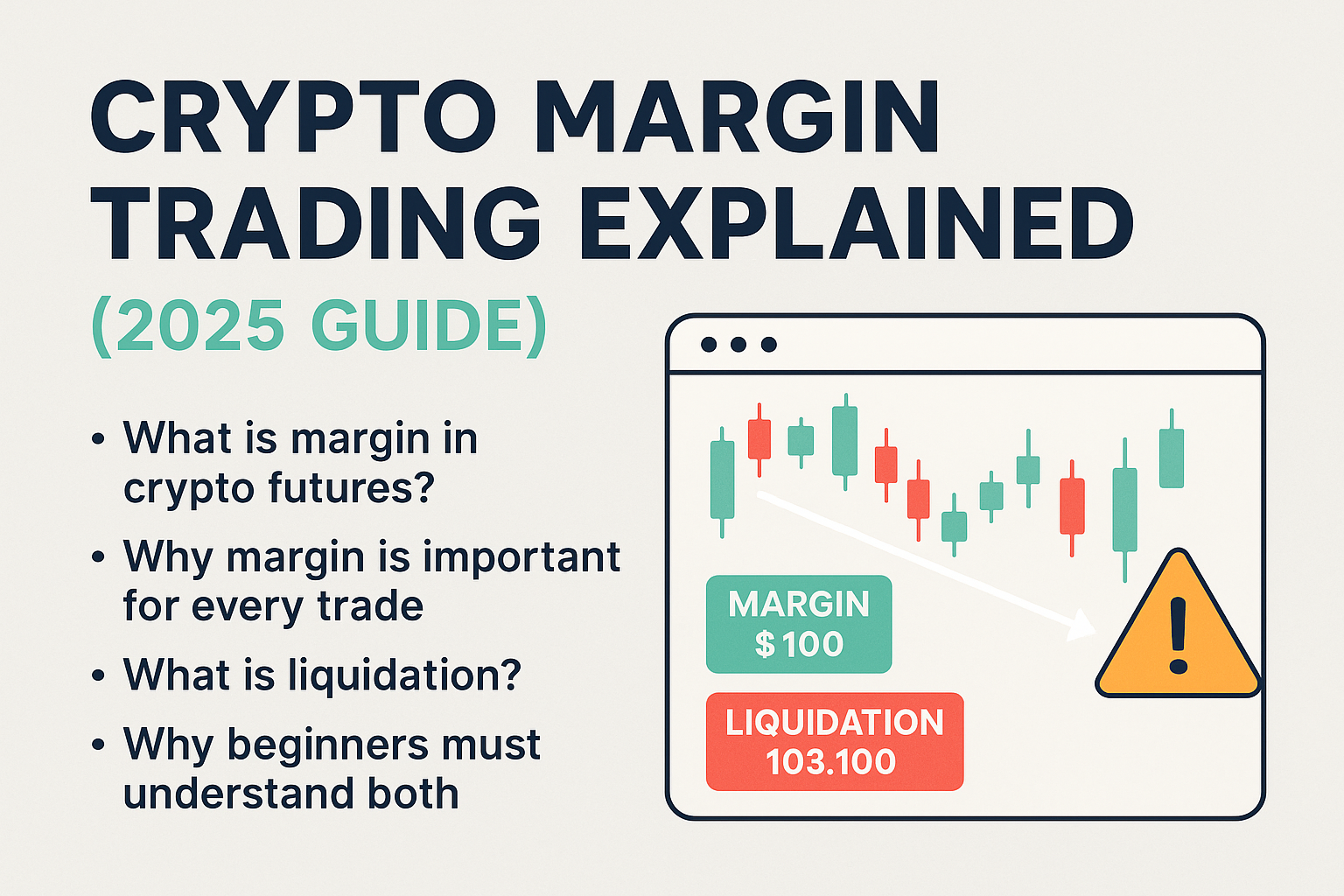

Crypto futures trading has become one of the most popular ways to make fast profits in 2025 — but with that opportunity comes serious risk. One small mistake in leverage or margin can wipe out your entire trade. That’s why understanding how margin works is not just important — it’s absolutely essential.

Margin is the amount of your own money that you put into a leveraged trade. It acts like a security deposit. The exchange gives you more buying power based on how much margin you provide. But if the trade goes wrong and your margin runs too low, your position can be liquidated — and you lose that money.

What Is Margin in Crypto Futures?

Margin is the amount you need to open and support a leveraged position. It’s your “skin in the game.” With leverage, you can control a much larger trade using just a small amount of margin.

Example:

You use $100 margin with 10x leverage → you control a $1,000 position.

The more leverage you use, the less margin you need — but that also increases your risk of liquidation if the market moves against you.

Why Margin Is Important for Every Trade

Every trade in crypto futures depends on margin — it decides:

-

How much you can trade

-

How far your position can survive

-

How close you are to liquidation

If your margin is too low and your trade goes against you, even a 2–3% market move can force-close your position. That’s why traders must calculate margin carefully before entering any position.

What Is Liquidation?

Liquidation happens when your margin drops below the maintenance level. At that point, the exchange automatically closes your trade to prevent further loss.

It doesn’t matter if you think the market will bounce back — once liquidation starts, the trade ends. You lose your margin, and you don’t get a second chance.

This is the biggest risk in margin trading, and it happens faster than most beginners expect.

Why Beginners Must Understand Both

New traders often focus on “how much profit they can make” instead of how much risk they’re taking. They hear about 10x or 50x leverage and jump in — without knowing what margin, liquidation, or maintenance levels mean.

That’s how most beginners lose their capital early. But if you understand how margin and liquidation work together, you can build a strategy that protects your money first — and earns profit second.

In crypto, survival = success.

Margin is not a gamble — it’s a system. Learn it before using it.

How Margin Works in Futures

Margin is the heart of crypto futures trading. It’s what allows you to control large trades with just a small amount of your own money. Whether you’re trading Bitcoin, ETH, or altcoins — your entire position is built on how much margin you commit and what leverage you apply.

Instead of paying the full trade amount upfront, margin lets you borrow buying power from the exchange. But with that power comes a price — if your trade goes against you, and your margin drops too low, the trade can be force-closed. That’s why knowing how margin works is key to staying alive in futures.

What Is Margin in Simple Words?

In simple terms, margin is a deposit. It’s the money you put down to enter a trade. The exchange uses that money as collateral to allow you to open a bigger position.

You don’t need to own the full amount of the trade — just a small part of it. That part is your margin.

Margin vs Full Capital Trading

In spot trading, if you want to buy $1,000 worth of BTC, you must pay $1,000. But in futures with margin, you can control a $1,000 trade with just $100 (using 10x leverage).

That means:

-

You keep more cash free

-

You can take bigger positions

-

You get higher profit potential — but also higher risk

With margin, you gain flexibility — but lose safety if you don’t manage risk well.

How Margin Boosts Your Buying Power

Margin + leverage = more trading power.

Formula:

Trade size = Margin × Leverage

So if you have:

-

$100 margin

-

10x leverage

→ You can open a $1,000 position

Without margin, you’d need the full $1,000 to make that trade. With it, you only need $100 — and any % move on that $1,000 affects your gains or losses directly.

This is what makes margin so attractive — it multiplies your reach, but also your exposure.

Real-Life Example Using $100 and 10x Leverage

Let’s say:

-

BTC/USDT price = $103,000

-

You use $100 margin with 10x leverage

→ You open a $1,000 long position

If BTC rises by 5%:

-

Your position becomes $1,050

-

You gain $50 profit (50% return on your $100)

If BTC drops by 5%:

-

Position falls to $950

-

You lose $50

-

If price keeps dropping and your margin hits the maintenance level → Liquidation triggers

So margin trading can double your money fast — or erase it just as quickly. That’s why strategy, stop-loss, and proper sizing matter.

Initial Margin and Why It Matters

Initial margin is the first building block of every futures trade. It’s the amount of your own money that you need to deposit to open a leveraged position. Think of it as a security deposit that gives you permission to enter the trade.

If your initial margin is too low or incorrect, your trade won’t open — or it may get closed quickly due to liquidation. That’s why understanding it is essential for both planning your position size and protecting your capital.

What Is Initial Margin?

Initial margin is the minimum required amount you must put into a trade when using leverage. It depends on two things:

-

The total value of your trade

-

The leverage you’re using

The higher the leverage, the less margin you need — but the higher the risk of liquidation.

How Much You Need to Open a Trade

Use this simple formula:

Initial Margin = Trade Size ÷ Leverage

For example:

-

Trade size = $1,000

-

Leverage = 5x

→ Initial margin = $1,000 ÷ 5 = $200

So you only need $200 to control a $1,000 trade using 5x leverage.

Example: BTC/USDT Futures with 5x Leverage

Let’s say:

-

BTC price = $103,000

-

You want to go long with a position size of $5,000

-

You choose 5x leverage

Required initial margin = $5,000 ÷ 5 = $1,000

If you don’t have $1,000 in your futures wallet, the exchange won’t let you open this trade. You can either lower the position size or increase the leverage — but both affect your risk.

How to Check and Manage It

Every exchange like Binance, Bybit, and OKX shows your required margin before you confirm a trade.

Here’s how to manage it:

-

✅ Use the margin calculator before placing orders

-

Set alerts for margin ratio and liquidation price

-

➕ Add extra margin (manual top-up) if price nears your liquidation point

-

Reduce position size if needed to lower risk

Initial margin is your first line of defense. Use it wisely, and your trade gets the room it needs to move. Mismanage it — and you’re just one candle away from liquidation.

Maintenance Margin and Risk

Maintenance margin is the minimum amount of margin you must keep in your position at all times. While initial margin gets your trade started, maintenance margin keeps it alive. If your margin balance falls below this threshold, the platform will liquidate your trade to prevent further loss.

Even if your trade looks okay on the chart, a sudden drop in market price or rising funding costs can push you below this level — and once that happens, there’s no second chance.

What Is Maintenance Margin?

Maintenance margin is usually 0.5% to 1% of your total trade size. It’s the critical buffer that protects both you and the exchange.

If your available margin stays above this level, your position remains open. But if your equity falls below it, your trade is marked for automatic liquidation.

Why You Must Keep This Margin During the Trade

Once the trade is live, the exchange monitors your margin ratio 24/7. If your margin ratio reaches 100%, you’re at liquidation risk.

That’s why you must:

-

Track your margin ratio

-

Watch for “liquidation price” alerts

-

Add margin manually (top-up) if needed

Ignoring this can lead to a trade being closed — even if the market recovers afterward.

What Happens When It Falls Too Low

If your margin drops below the maintenance threshold, the system doesn’t wait. It immediately liquidates your trade at the next available price.

Example:

-

Trade size = $2,000

-

Maintenance margin = $10 (0.5%)

-

Your equity drops to $9 → Trade gets liquidated

You lose your full margin (and possibly more in cross margin), and the trade ends automatically.

How Margin Level Affects Liquidation

The lower your margin, the closer your liquidation price. High leverage shrinks your margin buffer, meaning just a small market move can trigger liquidation.

Keeping your margin above safe levels gives your trade room to breathe — especially in a volatile market. That’s why pro traders always watch their margin ratio, not just the charts.

What Is Liquidation in Futures?

Liquidation is the moment your margin runs out and your futures position is forcefully closed by the exchange. It’s not optional, not a suggestion — it’s automatic. When your losses eat up too much of your margin, the system steps in to protect the platform (and you) from going into negative balance.

For new traders, liquidation is often the biggest shock. One quick price drop, and your trade disappears — even if you were “almost right.” That’s why knowing how liquidation works is so important in crypto futures.

Simple Meaning of Liquidation

Liquidation means your position has lost too much value, and your margin balance has dropped below the minimum required level.

The exchange closes your trade instantly at market price to recover the borrowed funds and avoid deeper loss.

You don’t control this — once the system triggers liquidation, your trade is gone and your margin is lost.

How It Connects to Margin Levels

Every leveraged trade runs on two key levels:

-

Initial margin: to open the trade

-

Maintenance margin: to keep it alive

If your trade goes against you, your equity (remaining margin) decreases. When it hits the maintenance margin limit, your position is flagged, and if it drops even slightly more — the exchange triggers liquidation.

This is why small trades with high leverage get liquidated easily — there’s barely any buffer.

What Is Liquidation Price and How to Find It

Liquidation price is the exact market price at which your position will be closed by the exchange due to insufficient margin.

You can find your liquidation price:

-

Before opening a trade (using the margin calculator)

-

After opening a trade (inside the Positions tab)

Most platforms like Binance, Bybit, and OKX display it clearly so you can track how close you are to liquidation in real time.

Exchange Rules for Auto-Closing Trades

All major futures platforms follow these rules when margin is too low:

-

Margin ratio hits 100% or below

-

Position equity drops below maintenance margin

-

System auto-triggers liquidation engine

-

Trade is closed at the next available market price

Some platforms also apply Auto-Deleverage (ADL) when volatility is extreme — closing winning trades to balance the risk across the system.

That’s why it’s critical to monitor your margin levels and set stop-losses before liquidation becomes unavoidable.

How Margin Affects Liquidation Risk

The amount of margin you use directly impacts how close you are to liquidation. Low margin = high risk. The smaller your margin, the less room your trade has to survive price swings. It’s like walking a tightrope — one sharp move and you’re out.

That’s why margin should always be planned based on market conditions, trade size, and leverage — not based on how much you “hope” to earn.

Low Margin = Higher Liquidation Risk

When you use small margin, even a 2–3% market drop can eat up your equity. You don’t have enough balance to absorb temporary losses, so the trade gets flagged for liquidation quickly.

Example:

Using $50 margin at 20x leverage = $1,000 trade

→ Just a 5% drop = $50 loss = margin gone = liquidation

Bigger margin gives your trade more breathing space.

High Leverage with Low Margin = Danger Zone

High leverage increases your trade size but shrinks your margin safety net. The higher your leverage, the closer your liquidation price sits to your entry point.

10x–25x leverage with low margin is already risky.

50x–100x leverage with low margin = almost guaranteed liquidation unless price moves in your favor immediately.

That’s why pros say: “Leverage is not the problem — margin control is.”

How Fast Prices Can Wipe Your Margin

Crypto is highly volatile. Coins like BTC, ETH, or SOL can swing 3–5% in minutes — sometimes seconds during news or high-volume events.

If you’re trading with tight margin and high leverage, that one candle is all it takes to:

-

Trigger margin call

-

Hit your liquidation price

-

Auto-close your trade — even before you react

Without stop-loss or buffer margin, you can lose your position faster than you expect.

How Exchanges Protect Themselves by Liquidating You

When your margin falls too low, the exchange isn’t just protecting you — it’s protecting itself. You’re trading with borrowed power (leverage), and the platform doesn’t want to lose money on your behalf.

So when your margin drops below the maintenance level, the system closes your trade:

-

To reclaim the borrowed amount

-

To prevent platform loss

-

And to avoid negative balances

This liquidation isn’t emotional — it’s automatic, and it keeps the whole trading system stable for everyone.

Tools to Track Your Margin Health

In futures trading, most people don’t lose because of bad analysis — they lose because they didn’t track their margin health. Knowing where your trade stands in real-time is key to avoiding liquidation. Thankfully, platforms like Binance, Bybit, and OKX offer tools to help you monitor everything from margin ratio to ADL status.

These tools are your early warning system — they won’t stop losses, but they’ll tell you when risk is getting close.

Margin Ratio and Margin Level Explained

The margin ratio tells you how close your position is to liquidation. It’s usually shown as a percentage:

-

0%–50% = Safe zone

-

70%–90% = Warning zone

-

100%+ = Danger zone (liquidation may trigger)

Many exchanges color-code this: green (safe), yellow (watch), red (risk). Margin level is similar — it compares your available equity vs. required maintenance margin.

Keep this number low = more safety.

Using Calculators Before Trading

Before you even open a trade, use the built-in margin calculator. It lets you input:

-

Entry price

-

Trade size

-

Leverage level

-

Margin mode (cross/isolated)

It shows:

-

Required initial margin

-

Liquidation price

-

Maintenance level

This one step can save you from getting liquidated due to poor planning.

Setting Alerts for Low Margin

Many platforms let you set custom margin alerts. These alerts warn you when your:

-

Margin ratio hits a set level (e.g. 80%)

-

Trade is nearing liquidation price

-

Wallet balance drops too low

Alerts are sent via:

-

Email

-

App push notification

-

On-screen popup

Smart traders use these alerts to add margin or exit early, not to panic after it’s too late.

Auto-Deleverage (ADL) and Risk Settings

ADL stands for Auto-Deleverage — a risk control tool used by exchanges in extreme conditions. It ranks your position based on:

-

Leverage

-

Profit

-

Risk level

If mass liquidations happen, trades with the highest ADL score (often 4 or 5 bars) are closed first — even if they’re winning.

You can see your ADL rank on most platforms next to your open position. To reduce ADL risk, lower your leverage or reduce position size when markets get unstable.

Safe Margin Practices for 2025

In 2025, crypto markets are faster and more volatile than ever. Margin trading can multiply your gains — but without discipline, it can wipe your account. That’s why smart traders follow strict margin rules to protect their capital first and profit second.

Here are the key safety practices you must follow when using margin in today’s fast-paced futures market.

Start with Low Leverage (2x–5x)

If you’re new or still learning strategy, always start with 2x to 5x leverage. This gives your trade more room to survive short-term price dips without hitting liquidation.

Low leverage reduces stress, risk, and helps you learn without burning your capital. You can scale up later — but never start high and regret it later.

Never Use All Your Funds in One Trade

One of the biggest mistakes beginners make is using 100% of their wallet balance in a single trade. If that trade fails, you’re wiped out instantly — no recovery possible.

Instead, use only 10%–30% of your available funds per trade. This gives you backup capital for future entries, stop-loss recovery, or adding margin when needed.

Always Set Stop-Loss and Take-Profit

A stop-loss protects you from surprise liquidations, while a take-profit locks in your gains automatically. Without these two tools, your trade is completely exposed.

Even professional traders use tight SL and TP settings to manage emotional trading. Decide your risk before entering — not while watching candles move.

Learn Risk-to-Reward Before Using Margin

Margin multiplies everything — both profits and losses. That’s why you need to understand risk-to-reward (R:R) ratios before using leverage.

A good R:R strategy looks like:

-

Risking $20 to make $60 (1:3 ratio)

-

Setting stop-loss at 2% and take-profit at 6%

-

Only trading when potential reward is worth the risk

Without clear R:R, you’re not trading — you’re gambling.

Real Examples from 2025

Margin trading in 2025 has created both fast millionaires and instant losses. The biggest difference between success and failure? Margin strategy. Let’s look at a few real-style examples to understand what went wrong — and what smart traders did right.

A Beginner Using 100x Leverage and Losing in Seconds

In April 2025, a new trader on MEXC opened a 100x long on BTC/USDT with $50 margin when BTC was at $102,700. He was excited about a breakout but didn’t set a stop-loss.

BTC dropped just 0.9% in under 2 minutes due to a U.S. CPI release. That small move wiped out his entire $50. Liquidation was instant. He lost everything before he could even react.

Lesson: High leverage gives no room to breathe. Even tiny price changes can destroy your position. Beginners should never use 100x.

Smart Trader Using 5x With Margin Buffer Survives

At the same time, another trader on OKX entered a 5x BTC long using $300 margin for a $1,500 position. He had a 10% stop-loss and a goal of 20% profit.

BTC dropped by 1.2%, but since he had used low leverage and had enough margin buffer, he stayed in the trade. Two hours later, BTC rebounded by 3%, and he exited with $45 profit.

✅ Lesson: Smart traders give themselves time and space. Proper margin + lower leverage = survival.

Why Most Liquidations Happen Under 10x

Surprisingly, most futures liquidations on Binance and Bybit in 2025 happened on trades between 5x and 10x leverage. Why?

Because traders use small margin sizes without calculating risk. For example, putting $20 on a 10x trade means you’re trading $200 with almost no buffer. Just a 5% drop and your margin is gone.

⚠️ Lesson: It’s not just high leverage that kills — it’s low margin + no planning at any leverage level.

Lessons from Recent BTC and SOL Trades

In June 2025:

-

A 10x SOL/USDT long got liquidated after a 6% price drop during Solana network congestion

-

BTC had a sudden wick from $103,200 to $101,800 during ETF news — wiping out over $120M in liquidations across Bybit and OKX

Smart traders either had:

-

Lower leverage

-

Stop-loss set

-

Or cross-margin buffers

Lesson: Real-time volatility in 2025 is fast and unforgiving. Only calculated margin strategy survives.

Conclusion

Margin trading opens the door to bigger profits with smaller capital — but it also opens the risk of fast, painful losses. Without the right planning, even a good trade idea can end in liquidation. That’s why margin should never be used blindly.

Understanding both initial and maintenance margin is key. Know how they work, when they apply, and how they connect to liquidation risk. Whether you’re trading with 5x or 50x leverage, your survival depends on how well you manage your margin levels.

Your funds are your future — don’t risk them casually. Margin is a powerful tool, not a shortcut to quick gains. Treat it like a weapon: useful when controlled, dangerous when mishandled.

✅ Smart trading isn’t about guessing price direction — it’s about managing risk, using tools, and staying in the game. The longer you survive, the more you win.