Tether (USDT) is a special type of cryptocurrency called a “stablecoin.” Unlike other cryptocurrencies like Bitcoin, which can go up and down in price very quickly, Tether’s price stays the same.

This is because Tether is “pegged” to the US Dollar. In simple terms, 1 Tether is always equal to 1 US Dollar. So, if you own 100 Tether, it will be worth 100 US Dollars, no matter what happens in the market. People use Tether to avoid losing money due to the price swings of other cryptocurrencies, making it a safe way to store value in the crypto world.

Role of Tether (USDT) in the Cryptocurrency Ecosystem

Tether (USDT) is very important in the cryptocurrency market because it brings stability. Since many cryptocurrencies can rise and fall in value very quickly, Tether helps investors keep their money safe from these changes. If someone wants to protect their money during times of high volatility (big price changes), they can change their crypto into Tether and hold it until they are ready to buy other coins again.

Tether also helps people move money easily between different cryptocurrency exchanges. Without Tether, they would have to convert their coins into regular money (like US Dollars), which can be slow and costly. With Tether, people can quickly transfer funds between exchanges without needing to change them into traditional money. This makes it an essential tool for many people in the crypto market.

Understanding the Delisting Process

What Does Delisting Mean?

Delisting is when a cryptocurrency or any asset is removed from a trading platform or exchange. When a coin is delisted, it means that users can no longer buy, sell, or trade it on that platform. This usually happens if the exchange feels the coin no longer meets its rules or standards. It’s like taking a product off a store shelf because it no longer meets the store’s quality requirements.

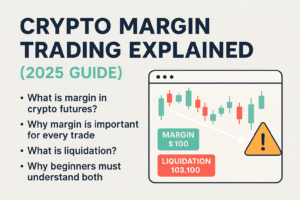

Criteria for Delisting Stablecoins

Stablecoins like Tether (USDT) can also be delisted from exchanges if they don’t meet certain rules. Here are some common reasons why this might happen:

- Regulatory Problems: If the stablecoin breaks any laws or regulations in certain countries, it could be delisted. Governments might require stablecoins to follow strict rules for protection and transparency.

- Lack of Trust or Transparency: Stablecoins are backed by real-world assets like US Dollars. If an exchange is not sure about the backing or reserves of the stablecoin, they may decide to delist it for safety reasons. Users need to know that their coin is secure and truly backed by what it claims.

- Low Trading Volume: If a stablecoin is not being used much on the platform (people are not buying or selling it), the exchange might remove it because it’s not helpful for the users. Exchanges focus on coins that are actively traded and have high demand.

- Security Issues: If there are technical problems with the stablecoin, such as risks to users’ funds or the platform’s security, the exchange might remove it to protect investors.

Delisting helps exchanges keep their platforms secure, trustworthy, and compliant with regulations. It ensures users are trading coins that meet the necessary standards.

Why is USDT Being Delisted?

EU’s MiCA Regulations and Compliance Issues

The European Union has introduced a new set of rules called MiCA (Markets in Crypto-Assets Regulation), which is designed to regulate cryptocurrencies more carefully. These rules aim to make sure that all cryptocurrencies, including stablecoins like USDT, are safe for investors and comply with the law. If USDT does not meet these new standards, it could be removed (delisted) from exchanges in the EU. This is because exchanges must follow the laws of the countries they operate in. If USDT doesn’t follow the MiCA rules, it can face serious issues with regulators, and exchanges would have to stop offering it to avoid legal problems.

Transparency and Reserve Challenges

For a stablecoin like USDT, it’s crucial that users trust it. USDT is supposed to be backed by real money or other assets, like US Dollars, to keep its value steady. If USDT cannot clearly show that it has enough real assets to back every USDT coin in circulation, people might start to worry about its safety. If exchanges or regulators feel that USDT isn’t transparent enough about its reserves, they might decide to delist it. Without full transparency, users may not trust that USDT is truly secure, leading exchanges to remove it to protect their customers.

Regulatory Crackdowns on Stablecoins

Governments around the world are becoming stricter about how stablecoins like USDT should operate. Some regulators believe that stablecoins should be treated like traditional financial products, which means they should be regulated in the same way as banks or other financial companies. If USDT doesn’t meet these new regulations, or if it faces legal challenges, exchanges might decide to delist it to avoid breaking the law. For example, if USDT doesn’t follow the rules on how it is issued or traded, or if it faces action from government authorities, exchanges may stop offering it to protect themselves from penalties or legal issues. This is part of a larger trend where governments are paying more attention to stablecoins to make sure they are safe and trustworthy for the public.

The Bigger Picture: Why is This Happening?

Global Push for Crypto Regulation

Around the world, governments and regulators are becoming more focused on controlling cryptocurrencies like USDT. This is because, as the crypto market grows, there are concerns about its potential risks, such as fraud, money laundering, and market instability. Many countries are working on creating clear rules to manage how cryptocurrencies should be used, traded, and secured. By regulating stablecoins like USDT, governments aim to protect investors and keep the market safe from potential dangers, ensuring that crypto can be used responsibly.

Rise of Central Bank Digital Currencies (CBDCs)

In response to the growing use of cryptocurrencies, many governments are exploring or developing their own digital currencies, called Central Bank Digital Currencies (CBDCs). These are digital forms of money issued and controlled by governments, unlike decentralized cryptocurrencies like USDT. CBDCs are seen as a way for governments to maintain control over their monetary systems while offering the benefits of digital currencies. As CBDCs become more popular, stablecoins like USDT may face more pressure, as they compete with government-backed digital currencies that are considered safer and more reliable by regulators.

Balancing Innovation with Consumer Protection

Cryptocurrencies, including stablecoins like USDT, are innovative technologies that offer new ways for people to store, transfer, and use money. However, with this innovation comes the need to protect consumers. Governments want to make sure that cryptocurrencies don’t lead to scams or financial losses for investors. The challenge is finding a balance between allowing new, innovative technologies to grow and ensuring that consumers are protected from potential risks. This is why some stablecoins face increasing pressure to comply with rules and regulations, as regulators work to create a safer, more trustworthy environment for everyone in the crypto market.

Impact of USDT Delisting on the Market

Reduced Liquidity and Trading Volumes

If USDT is delisted from major exchanges, it could lead to a decrease in market liquidity. Liquidity refers to how easily assets can be bought or sold without causing large price changes. Since USDT is widely used for trading and as a stable store of value, removing it from exchanges would reduce the ease with which traders can move in and out of positions. This could lead to lower trading volumes, meaning fewer trades occur, and markets might become less efficient and more volatile.

Shift in Stablecoin Preferences (USDC, DAI, etc.)

In the event of USDT delisting, traders and investors may turn to other stablecoins such as USDC (USD Coin) or DAI. These stablecoins could see increased demand as people look for alternatives to USDT. USDC, for example, is another widely used stablecoin that is backed by US Dollars and is known for its transparency. DAI, on the other hand, is a decentralized stablecoin that operates on the Ethereum blockchain. The shift towards other stablecoins could change the market dynamics and lead to a new stablecoin leader in the market.

Potential Ripple Effects Across Global Exchanges

The delisting of USDT from major exchanges could have ripple effects across global markets. Many exchanges around the world, particularly those in regions like Asia and Europe, rely heavily on USDT for trading pairs and liquidity. If USDT is removed from these platforms, exchanges might experience disruptions, such as changes in trading pairs, or even require users to switch to different stablecoins. Additionally, smaller exchanges that rely on USDT for liquidity could face challenges in maintaining their trading volumes and offering competitive services to users. This global impact could shift how cryptocurrencies are traded and affect the overall stability of the crypto market.

What Happens Next for Traders?

Immediate Actions for Protecting Assets

Traders who hold USDT on exchanges that may delist it should act quickly to protect their assets. The first step is to transfer USDT into a more stable form, such as a fiat currency (USD, EUR) or another widely accepted stablecoin. This will prevent traders from being exposed to any sudden price swings or complications that could arise if USDT is removed from the platform. It’s also important to monitor the news and announcements from exchanges to know when the delisting will happen, so traders can prepare in advance.

Diversifying into Alternative Stablecoins

After the potential delisting of USDT, traders should consider diversifying their holdings into other stablecoins such as USDC (USD Coin), DAI, or BUSD (Binance USD). These stablecoins are also pegged to the US Dollar and can serve the same purpose as USDT for trading or as a store of value. By spreading investments across multiple stablecoins, traders reduce the risk of being affected by a delisting of any single coin. It’s important to evaluate the transparency, security, and regulatory compliance of alternative stablecoins before moving assets.

Choosing Compliant Platforms

Traders should focus on using exchanges and platforms that comply with local regulations and are likely to offer more stable, secure trading options. It’s important to choose platforms that support stablecoins with a strong track record, proper reserve backing, and regulatory compliance. These platforms are less likely to delist stablecoins and will provide a more reliable environment for trading. Traders should also keep an eye on the future of MiCA regulations in Europe and other global regulatory developments to ensure they are using compliant platforms that follow the latest legal requirements.

Challenges Traders May Face

Difficulties in Converting USDT to Fiat or Other Cryptos

One of the major challenges traders could face after USDT is delisted is difficulty in converting it to fiat currency (like USD, EUR) or other cryptocurrencies. If USDT is removed from major exchanges, it may become harder to find platforms where you can directly trade or exchange it. This could result in delays and extra steps to convert USDT to another coin or fiat, especially on smaller or less popular platforms. Traders may have to use multiple platforms, which could increase complexity and risk.

Increased Transaction Costs Due to Limited Platforms

When a cryptocurrency like USDT is delisted from popular exchanges, there are usually fewer platforms available where it can be traded or converted. As a result, traders may face higher transaction fees. Smaller platforms or alternative exchanges may charge more to cover their costs or to attract customers. Additionally, if there are fewer exchanges offering USDT, it could lead to lower liquidity and more slippage, which means traders might not get the best price for their trades.

Risk of Market Volatility Post-Delisting

Once USDT is delisted, the crypto market could experience increased volatility. Since USDT is one of the most widely used stablecoins, its removal from exchanges could cause uncertainty, leading to price fluctuations in other cryptocurrencies. Traders may face more risks when moving their assets between coins, especially if market confidence drops. Furthermore, a sudden loss of USDT liquidity in the market can make it harder to execute trades without significant price changes, increasing overall market instability.

Solutions for Crypto Traders

How to Transition Smoothly to Other Stablecoins

When USDT is delisted, here’s how you can easily switch to other stablecoins:

- Choose a New Stablecoin: Look for stablecoins like USDC, DAI, or BUSD. These are also tied to the US Dollar and keep their value stable. They are popular and work similarly to USDT. Take some time to understand their benefits and choose the one that suits you best.

- Move Your Funds Early: Once you know that USDT will be removed from your exchange, move your funds to a new stablecoin before the delisting happens. Many exchanges let you quickly swap USDT for other stablecoins, so do it early to avoid any issues.

- Diversify Your Holdings: Instead of keeping all your funds in one stablecoin, try to spread your assets across different stablecoins. This will help you avoid putting all your eggs in one basket and reduce risks if one coin faces problems.

Ensuring Regulatory Compliance with Future Trades

To make sure your future trades follow the rules:

- Keep Up with Regulations: Different countries have different rules for cryptocurrencies. For example, Europe is introducing strict regulations for stablecoins, like MiCA. Stay updated with the latest news about these rules to avoid problems.

- Use Regulated Exchanges: Pick exchanges that follow the law and have good reputations. Regulated exchanges are less likely to face legal issues and will provide a safer place to trade.

- Choose Stablecoins that Follow the Rules: Some stablecoins are more compliant with regulations than others. For example, USDC is considered more transparent and is accepted by many regulators. Using these coins helps you stay on the safe side.

Using Decentralized Platforms for More Flexibility

Decentralized exchanges (DEXs) can be a good option if you want more freedom:

- More Coin Options: DEXs usually offer a wide range of stablecoins and other cryptocurrencies. This means you can easily switch between coins without worrying about them being delisted.

- Keep Control of Your Funds: On DEXs, you don’t need to trust a third party with your money. You keep control of your assets, which means there is less risk if the platform faces problems.

- Lower Fees: DEXs often have lower fees compared to centralized exchanges, especially when you are dealing with stablecoins. But make sure you choose reliable platforms that are known for security and ease of use.

Future of Stablecoins Post-USDT Delisting

Will Tether Adapt to New Regulations?

As global regulations around cryptocurrencies get stricter, Tether (USDT) will need to adjust to new rules. Tether Limited, the company behind USDT, has faced criticism in the past due to concerns about the transparency and backing of its reserves. To stay relevant in the market, Tether will have to work with regulators to make sure it complies with new laws. This may involve regular audits, providing clear reports about its reserves, and following stricter security measures.

If Tether wants to stay widely used, it will have to prove that it is transparent and stable enough to meet the needs of both regulators and traders.

The Rise of Regulatory-Compliant Stablecoins

As regulations become more important, we are likely to see more regulatory-compliant stablecoins in the market. These stablecoins follow strict rules that make them safer and more transparent. Some of the popular regulatory-compliant stablecoins include:

- USDC: USDC is known for being fully backed by the US Dollar, and it undergoes regular audits to prove its stability.

- BUSD: Binance’s stablecoin, BUSD, is issued by Paxos, a company regulated by the New York Department of Financial Services. This makes BUSD one of the safest and most transparent stablecoins available.

- DAI: DAI is a decentralized stablecoin that uses an algorithm to maintain its value. It’s becoming a popular choice for those looking for more control over their assets.

As governments continue to regulate the market, more people will look for stablecoins that offer transparency and compliance with the law.

Potential Market Trends in 2025

Looking towards 2025, we can expect several key trends in the stablecoin market:

- Increased Regulatory Attention:

- Governments worldwide are expected to introduce more detailed regulations for stablecoins. This means that stablecoins will have to be more transparent, undergo regular audits, and manage their reserves better to meet new rules.

- Rise of Central Bank Digital Currencies (CBDCs):

- Many countries are working on their own digital currencies, known as Central Bank Digital Currencies (CBDCs). These could compete with stablecoins like USDT. In the future, governments might prefer to use their own digital currencies rather than relying on private stablecoins.

- More Use in Traditional Finance:

- As rules become clearer, stablecoins will likely be used more in regular finance. Banks and large companies could start using stablecoins for payments and savings. PayPal and Square might adopt stablecoins as a way to make transactions easier and cheaper.

- Growth of Decentralized Stablecoins:

- Decentralized finance (DeFi) is becoming more popular, and stablecoins that are not controlled by a single company, like DAI, could see increased demand. These coins provide more freedom and less reliance on centralized institutions.

In 2025, the stablecoin market will be shaped by more government regulations, the growth of CBDCs, and the rise of decentralized financial systems. Tether and other stablecoins will need to adapt to stay competitive and meet the needs of traders and regulators.

Steps to Safeguard Your Investments

Portfolio Diversification Tips

To protect your investments, it’s important not to put all your money into one stablecoin like USDT. Instead, spread your investments across different stablecoins like USDC and DAI. This way, if one stablecoin faces issues, your risk is reduced. You can also consider investing in other cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) for long-term growth, even though they can be more unpredictable. Make sure to use different exchanges for your assets, so you’re not risking everything on one platform. Checking your portfolio regularly is also important to make sure everything is going well.

Monitoring Exchange Announcements

It’s also very important to keep an eye on news from the exchanges where you trade. Exchanges may announce changes like delisting coins, which could affect your investments. By staying updated on new listings, you can find new opportunities to add to your portfolio. Exchanges also share information about changes in rules or regulations, which could impact your coins. Keeping up with these updates helps you avoid surprises and stay on top of things.

Importance of Staying Educated on Regulations

Staying informed about the rules is crucial for protecting your investments. Cryptocurrency rules are always changing, and understanding these changes ensures that you’re trading safely and legally. By choosing coins that follow the rules, like USDC or BUSD, you reduce the risk of having them removed from exchanges or banned. Being aware of regulations also helps you understand how they may affect the market and gives you the chance to adjust your strategy if needed. By following these steps, you can help keep your investments safe and secure.

Conclusion

Key Insights from the USDT Delisting

The delisting of USDT from certain exchanges highlights the growing importance of regulations in the cryptocurrency market. Tether (USDT) has faced increased scrutiny due to concerns about its transparency and reserves. This event emphasizes the need for investors to diversify their portfolios and stay informed about potential delistings or regulatory changes. Choosing regulatory-compliant stablecoins like USDC or BUSD can reduce risk and ensure that your investments remain secure in the long term.

Staying Ahead in a Rapidly Changing Market

The cryptocurrency market is constantly evolving, and staying ahead means being proactive. Regularly monitoring exchange announcements and keeping up with new regulations will help you make informed decisions. Diversifying your investments and being prepared for potential changes ensures that you’re protected in times of uncertainty. By adapting to new rules and trends, you can continue to navigate the market confidently and safeguard your investments.

FAQs About USDT Delisting

- What does USDT delisting mean?

- USDT delisting means that a cryptocurrency exchange will stop offering USDT for trading.

- Why is USDT being delisted?

- USDT is being delisted because of concerns from regulators about its reserves and the rules surrounding stablecoins.

- How will the USDT delisting affect my investments?

- If you have USDT on an exchange that delists it, you may not be able to trade or withdraw it easily. It’s important to keep an eye on announcements.

- Can I still use USDT after delisting?

- Yes, you can still use USDT on exchanges where it is listed or in decentralized exchanges, but it may become harder to trade if it’s delisted from some platforms.

- What other stablecoins can I use instead of USDT?

- You can use other stablecoins like USDC, DAI, and BUSD as alternatives to USDT. They are widely accepted and trusted.

- How do I protect my investments if USDT gets delisted?

- Diversify your portfolio by using other stablecoins and cryptocurrencies. Stay updated on exchange announcements to take quick action if needed.

- Will USDT be delisted from all exchanges?

- No, USDT may not be delisted from all exchanges, but some platforms may choose to remove it due to regulatory issues.

- How do I know if my exchange is delisting USDT?

- Exchanges usually inform users about delisting USDT through emails or updates on their website. Keep an eye on these updates.

- Can I transfer my USDT to another exchange before delisting?

- Yes, you can transfer your USDT to another exchange or wallet that still supports it before it gets delisted.

- What happens to the value of USDT after delisting?

- The value of USDT should stay the same, as it is a stablecoin tied to the US Dollar. But, it may be harder to trade, affecting its liquidity and access.